How Bankruptcy Attorney Near Me can Save You Time, Stress, and Money.

Wiki Article

4 Simple Techniques For Bankruptcy Bill

Table of ContentsThe Bankruptcy Attorney DiariesThe Main Principles Of Bankruptcy Attorney Near Me Bankruptcy Business Can Be Fun For EveryoneBankruptcy Business - QuestionsSome Known Details About Bankruptcy Information Bankruptcy Attorney Things To Know Before You Get This

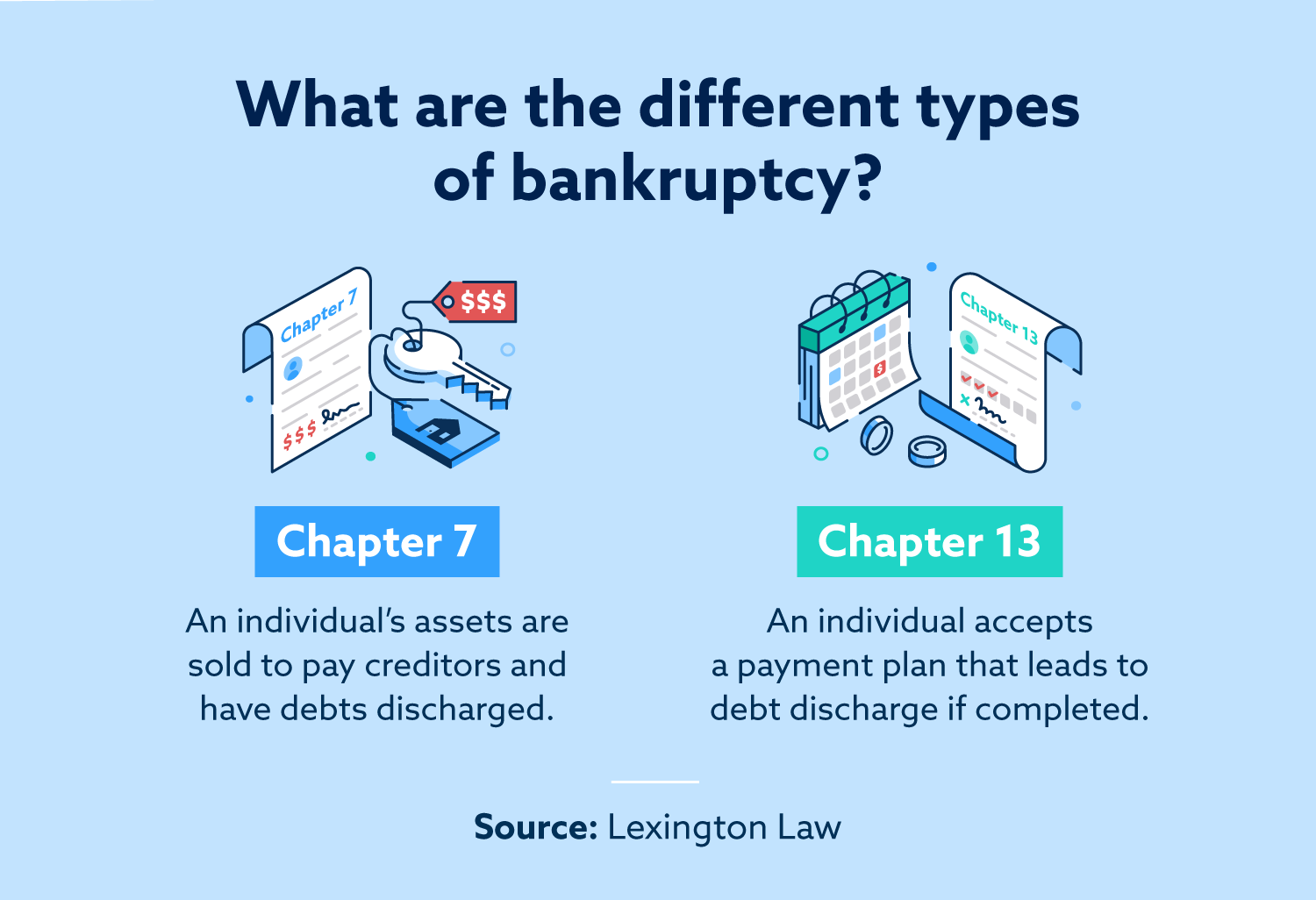

Phase 13 is commonly preferable to phase 7 due to the fact that it allows the debtor to maintain an important possession, such as a home as well as permits the borrower to propose a "strategy" to pay back financial institutions over time typically 3-5 years. Chapter 13 is also utilized by customer borrowers that do not receive phase 7 alleviation under the ways test.Phase 13 is really various from phase 7 because the phase 13 borrower generally remains in possession of the residential or commercial property of the estate as well as pays to financial institutions, via the trustee, based on the debtor's awaited revenue over the life of the strategy. Unlike chapter 7, the debtor does not obtain an instant discharge of financial debts.

This magazine reviews the applicability of Phase 15 where a borrower or its residential or commercial property undergoes the laws of the United States as well as one or even more international nations. For more information about submitting bankruptcy, contact our offices today. Our seasoned team can assist you obtain a financial obligation free clean slate.

Bankruptcy Law in the United States is Federal Regulation under Title 11 of the United States Code. Those are actual phases "in the publication" of the Insolvency Code, as well as each Phase affords distinct stipulations.

Bankruptcy Information for Dummies

In a corporate atmosphere, a Phase 7 bankruptcy is a liquidation. In an individual Chapter 7 personal bankruptcy, there is no liquidation of the person.

There is no minimum amount of financial obligation called for in order to be qualified to file for Personal bankruptcy. All financial debt must be noted on a Bankruptcy petition.

If you took a financing to get an automobile and can not make your month-to-month payments, your lorry might be repossessed by the lender. An usual period to be worried about foreclosure would be 45-75 days misbehavior. There are several

Some Of Bankruptcy Bill

Also if you have nondischargeable debt, bankruptcy could still be a choice.You'll utilize the exact same exemptions in both Phases 7 and also 13.

, you 'd lose the nonexempt residential property, and the trustee appointed to manage your case would certainly sell it as well as offer the earnings to your financial institutions., you do not shed nonexempt residential property. Rather, you have to pay lenders what it's worth via the payment plan.

For the most component, companies do not file for Chapter 7 or 13. Instead, consider Phase 11 or Phase 11 subchapter V for tiny businesses.

The Ultimate Guide To Bankruptcy

Receiving Chapter 13 isn't ever straightforward, and as a result of the countless complicated regulations, you'll desire to work with a bankruptcy lawyer. Till after that, you can find out about the Chapter 13 settlement strategy and get a suggestion concerning whether you make adequate earnings to cover what you'll need to pay.It's not ideal, however it will certainly reveal you what you must pay (you might have to pay even more). Soon after you submit your "petition" or personal bankruptcy documents, calls, letters, wage garnishments, and check this site out also even collection lawsuits ought to come to a stop.

At the conference, the trustee will certainly check your identification and also ask inquiries about your filing - bankruptcy australia. Financial institutions can show up and also ask questions as well, however they hardly ever do.

Generally, after one year you will be discharged from insolvency as well as check my blog all of your financial debts will certainly be crossed out. Bankruptcy manage both protected as well as unprotected financial debt. A guaranteed financial debt is a financing on which residential property or products are readily available as security versus non-payment. Home mortgages as well as auto loan are one of the most common protected car loans.

Bankruptcy Can Be Fun For Anyone

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

Its internet site also has user-friendly details and overviews on insolvency. In some situations, the High Court can make you bankrupt at the request of a lender. This demand is made in a paper called a request. A financial institution can request for bankruptcy versus you if you have committed an act of personal bankruptcy within the previous 3 months.

As quickly as your personal bankruptcy starts, you are cost-free of financial debt. The Official Assignee currently owns your possessions and also administers your estate. Your lenders can no more seek payment straight from you. They should deal straight with the Authorities Assignee and all correspondence must be sent to him. You must contribute any type of surplus revenue to the Official Assignee.

Any person can check this register. Read much more in the ISI guide After you are made bankrupt (pdf). The Authorities Assignee will discuss a Revenue Repayment Contract or seek an Earnings Payment Order for the surplus of your earnings over the affordable living costs for your situation, based on the ISI's standards.

An Unbiased View of Bankruptcy Attorney Near Me

If you obtain possessions after the day when you are made bankrupt (as an example, via inheritance) the Authorities Assignee can assert them and also market them for the advantage of your financial institutions. If you possess a family home, on your own or with another person, the Official Assignee might just sell it with the previous approval of the court.If redirected here you hold home jointly (as an example, with your spouse) your insolvency will certainly create the joint possession to be divided in between the Official Assignee and your non-bankrupt co-owner. If the Authorities Assignee has actually not offered your residence within 3 years, possession might immediately transfer back to you, unless or else agreed.

Report this wiki page